Professional fund tax services

Professional fund tax services

Investing across borders has many corporate tax implications.

Whether you’re looking to launch a new fund, fundraise for an existing fund, or stay on top of regulatory requirements to ensure compliance, you need to structure your fund in a tax efficient manner, taking into account all tax implications of both your home country and your target country.

Experts in property tax across multiple borders

To invest and expand across borders you’ll need a local tax expert to help you solve your corporation tax and compliance issues with ease, to lift the burden from you and your team.

At the same time, having the right technology in place is crucial to maintaining risk control and data security, as well as delivering timely and accurate reporting.

We can help you with:

Tax automation

We’ve added the best tax automation technology to our purpose-built accounting platform.

Our tax automation tool allows us to monitor your obligations in real time and keep accurate records; gaining agility, avoiding the duplication of tasks, establishing control processes and guaranteeing absence of errors.

This tax automation process saves you countless hours managing manual tasks allowing your teams to focus on more value-add tasks.

We’ll also ensure regulatory compliance in different jurisdictions and give you the strongest guarantee of confidentiality and data security.

Auxadi can help

With more than 40 years’ experience in Europe and the Americas, our people can help you navigate execute and implement the tax structure you require, and support you with your international fund tax compliance requirements. Our teams are experienced in all areas of tax legislation – we submitted over 26,000 client tax returns across 50 different tax regimes in 2020.

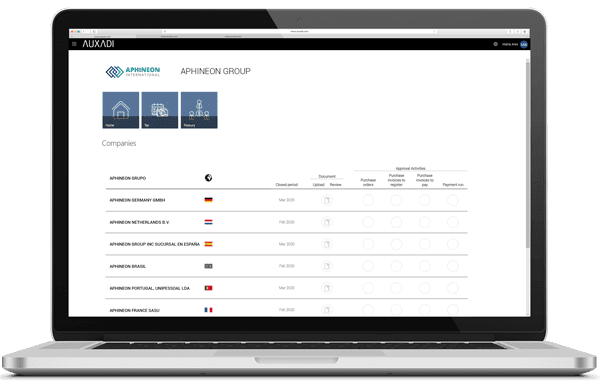

Our unique and intuitive MultiCountry platform is powered by Microsoft and can be fully customised to help you monitor your data, check your accounting reports, review your corporate tax filings, tax returns and so much more. Our IT solution can streamline your global tax accounting and administration, giving you access to all your international entities from a single, easily accessible portal.

Trusted international corporation tax experts

And, not only do our experts have local knowledge of their countries and local regulations, but they’re also experienced across multiple fund asset classes.

We can help you with:

- Tax compliance (multinational federal, state and municipal taxes)

- Official books and Annual Accounts

- Assistance in tax inspection and audit

- Reviews and claims to tax authorities

We can take the pain from your international tax compliance and make your life easier. And, our tax compliance offering complements our accounting and international payroll services, meaning you can partner with just one provider to tackle all your administrative needs.

To find out exactly how we can help with your international tax compliance, get in touch with our team today.

Monitor and manage your international subsidiaries with our MultiCountry online platform

Access our online platform that provides you with a global and harmonized view of the accounting of your international subsidiaries, with drill down functionality to check support documentation, such as: invoices, outstanding creditors, approve payment orders, manage the payroll processing cycle and so much more. Request a demo to see how our technology can help you.