In Colombia, income taxpayers that carry out transactions with foreign affiliates, companies located in free trade zones or companies located in low-tax jurisdictions must comply with the rules of the Transfer Pricing Regime. This regulation requires that, for tax purposes, ordinary and extraordinary income, as well as costs, deductions, assets and liabilities, be determined on an arm’s length basis.

Therefore, to comply with this regime, taxpayers must prepare and file the following reports:

- Local file: It should detail each transaction carried out by the taxpayer, demonstrating proper compliance with transfer pricing regulations.

- Master file: This report provides an overview of the multinational group, including a description of its global activities, general transfer pricing policies and the distribution of revenues, risks and costs worldwide.

- Country-by-country report: Since 2016, taxpayers meeting certain criteria must file a report reflecting the global allocation of income, taxes paid and other economic indicators of the multinational group.

Who is subject to this regime?

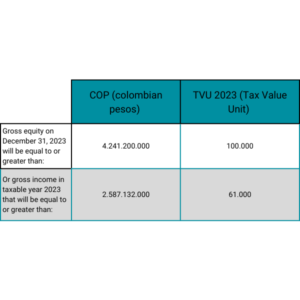

Articles 260-1 and 260-2 of the Tax Statute establish who is obliged to submit the informative return and reports. Consequently, those income taxpayers who, during 2023, carried out transactions with related entities. These are the requirements to comply:

According to country-by-country deadlines, there is still enough time: 13th December. Finally, the reports must be submitted virtually through DIAN’s online services.

Auxadi offers numerous services on the economic management of a company. Therefore, our experience spanning over 45 years can help you in international transfer pricing management in Colombia or other jurisdictions.

Can Auxadi help?

Auxadi can become your ideal partner. We offer a one stop shop value added outsourcing services in the areas of accounting and reporting, tax compliance, payroll management and representation services, among others.

Local Knowledge – International Coverage

Founded in 1979, Auxadi is a family-owned business working for multinational corporations, private equity funds and real estate funds. It’s the leading firm in international accounting, tax compliance and payroll services management connecting Europe and the Americas with the rest of the world, offering services in 50 countries. Its client list includes many of the top 100 PERE companies. Headquartered in Madrid, with offices in US and further 22 international subsidiaries, Auxadi serves 1,500+ SPVs across 50 jurisdictions.

All information contained in this publication is up to date on 2024. This content has been prepared for general guidance on matters of interest only, and does not constitute professional advice. You should not act upon the information contained in this chart without obtaining specific professional advice.No representation or warranty (express or implied) is given as to the accuracy or completeness of the information contained in this content, and, to the extent permitted by law, AUXADI does not accept or assume any liability, responsibility or duty of care for any consequences of you or anyone else acting, or refraining to act, in reliance on the information contained in this chart or for any decision based on it.