Exceptional Regularization Scheme for Tax, Customs, and Social Security Obligations (arts. 1 to 17)

What is this regulation?

It is a special measure that allows individuals and companies to regularize their outstanding tax, customs, and social security debts until 31 March 2024. This includes fines, interest, and other charges related to taxes not paid on time or correctly.

Why was it created?

This scheme was set up to give taxpayers an opportunity to catch up with their tax obligations without the usual consequences, such as liens or lawsuits. It encourages voluntary payment and eases the financial burden on those with outstanding debts.

What debts can be regularized?

A wide variety of debts can be regularized, such as:

- Unpaid taxes: VAT, Income Tax, Personal Property, etc.

- Fines: For tax or customs infractions.

- Interest: Generated by overdue payments.

- Debts related to the Solidarity Contribution for the Pandemic.

- Obligations of those who withhold or collect taxes on behalf of third parties.

What are the benefits?

The main benefit is the forgiveness of interest and penalties. The amount of money forgiven depends on several factors:

- Date of joining the scheme: The earlier you join, the greater the discount.

- Method of payment: Paying in cash or in a few installments gives greater benefits. In some cases, it is even possible to obtain full cancellation of the debt if certain requirements are met.

What happens if I do not pay?

If you do not join the scheme or do not comply with the payment plan, you will lose the benefits and the debts will remain in force. In addition, legal action may be taken against you.

What are the effects of joining?

- Suspension of legal actions: If you had a lawsuit in progress, it will be suspended.

- Interruption of the statute of limitations: The deadline for the State to sue you for your debts is stopped.

- Cancellation of the debt: If you comply with the payment plan, the debt is cancelled.

To sum up

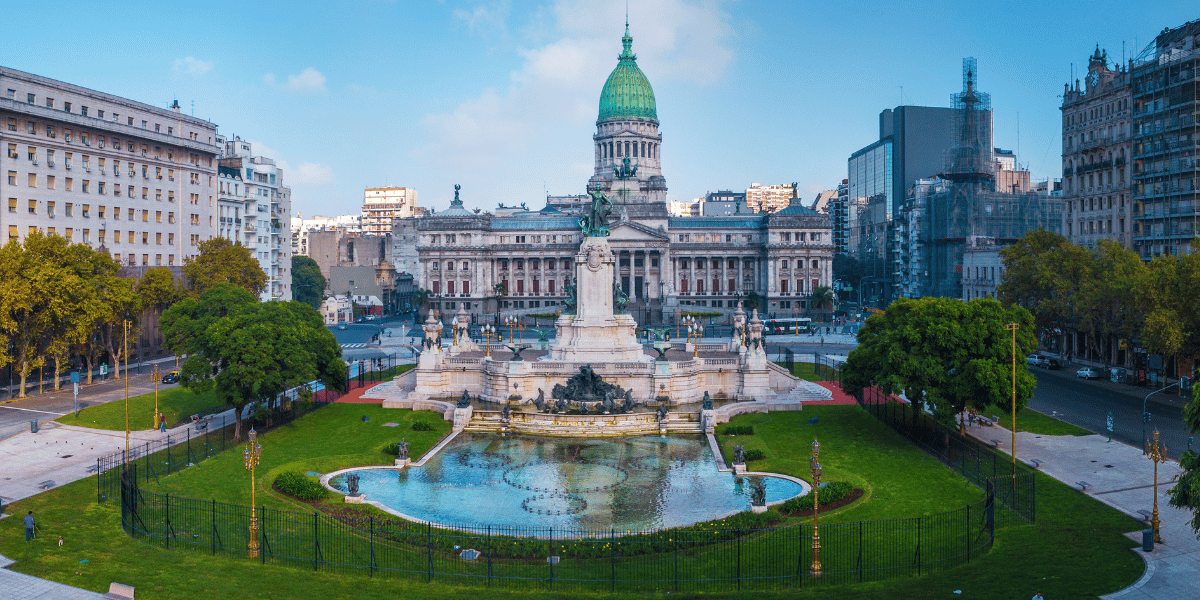

This regime is a unique opportunity to regularize your tax debts and avoid legal problems in Argentina. If you have outstanding debts, it is advisable to find out in detail about the requirements and benefits of this program.

If you have a subsidiary in Argentina or plan to expand there or to any of the more than 50 countries where Auxadi offers accounting, tax, and payroll services, contact us. With 45 years of experience and 1500 satisfied clients, we are here to make your life easier. Let us help you!

Can Auxadi help?

Auxadi can become your ideal partner. We offer a one stop shop value added outsourcing services in the areas of accounting and reporting, tax compliance, payroll management and representation services, among others.

Local Knowledge – International Coverage

Founded in 1979, Auxadi is a family-owned business working for multinational corporations, private equity funds and real estate funds. It’s the leading firm in international accounting, tax compliance and payroll services management connecting Europe and the Americas with the rest of the world, offering services in 50 countries. Its client list includes many of the top 100 PERE companies. Headquartered in Madrid, with offices in US and further 22 international subsidiaries, Auxadi serves 1,500+ SPVs across 50 jurisdictions.

All information contained in this publication is up to date on 2024. This content has been prepared for general guidance on matters of interest only, and does not constitute professional advice. You should not act upon the information contained in this chart without obtaining specific professional advice.No representation or warranty (express or implied) is given as to the accuracy or completeness of the information contained in this content, and, to the extent permitted by law, AUXADI does not accept or assume any liability, responsibility or duty of care for any consequences of you or anyone else acting, or refraining to act, in reliance on the information contained in this chart or for any decision based on it.