Labor relations in Mexico are characterized by both strict regulations and practices as well as some flexibility. The labor market has been influenced by significant labor reforms that have led to segmentation of the labor market itself. From here on, we will analyze practical and relevant aspects in Personnel Administration and Payroll in Mexico.

Mexico is made up of 32 federal states that are regulated by a uniform labor law: the Federal Labor Law. When a company decides to setup operations in Mexico, it will have to notify and register with the below mentioned authorities:

A fourth register may also be required before the National Institute of Immigration (depending on the company and employee base).

Once a company is registered, it will be able to initiate recruiting and hiring employees according to the following procedure:

- Federal law states a labor contract must be signed between employee and employer, which outlines the salary, benefits and other features of the employment relationship.

- No special registration format is required; a file containing the personal, academic, fiscal and social security information of the worker(s) is sufficient.

- The employee(s) must be registered on the Social Security website.

- you can also register salary changes, new hires and terminations

- Employees may be hired under indefinite and fixed contracts

Benefits and Withholdings in Payroll calculation

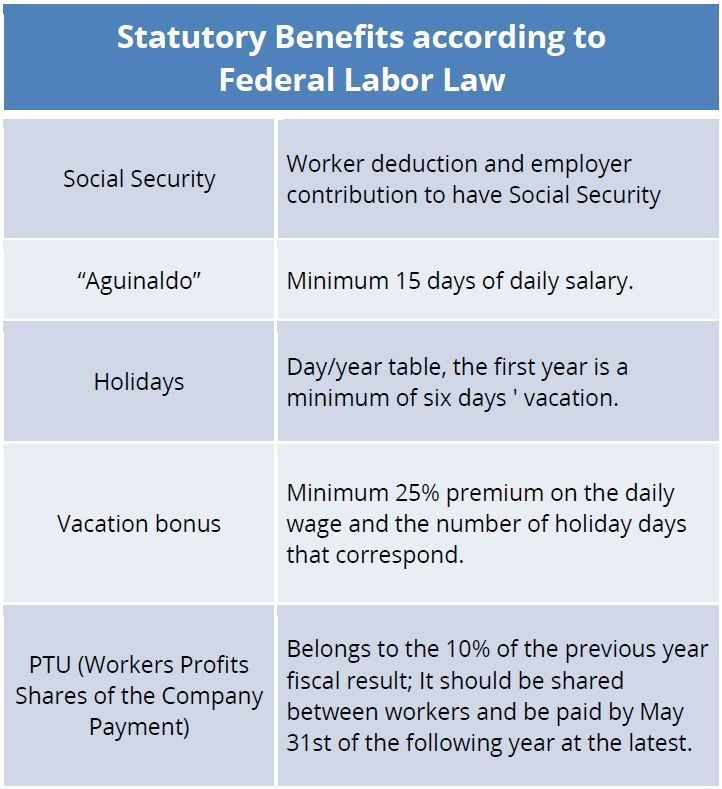

One of the main aspects that a company must consider when formalizing the payroll in Mexico is the OCT payment or Workers Profits Shares of the Company Payment. This type of disbursement requires a pre-cost analysis, as the law establishes that the income declared in the company’s Corporate Tax generates a tax benefit that must be distributed among the workers of the company.

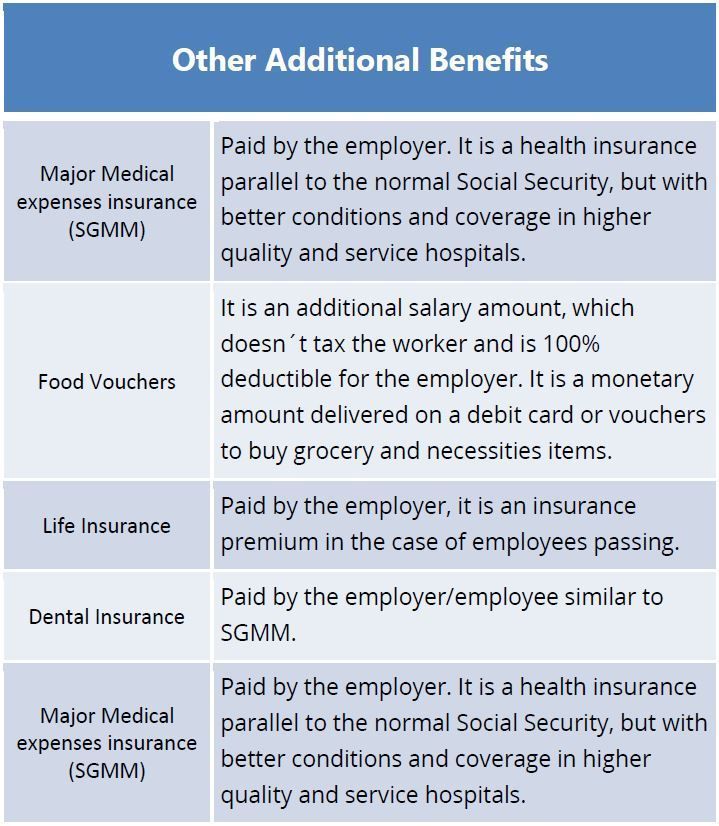

The below tables illustrates which are the statutory and additional benefits:

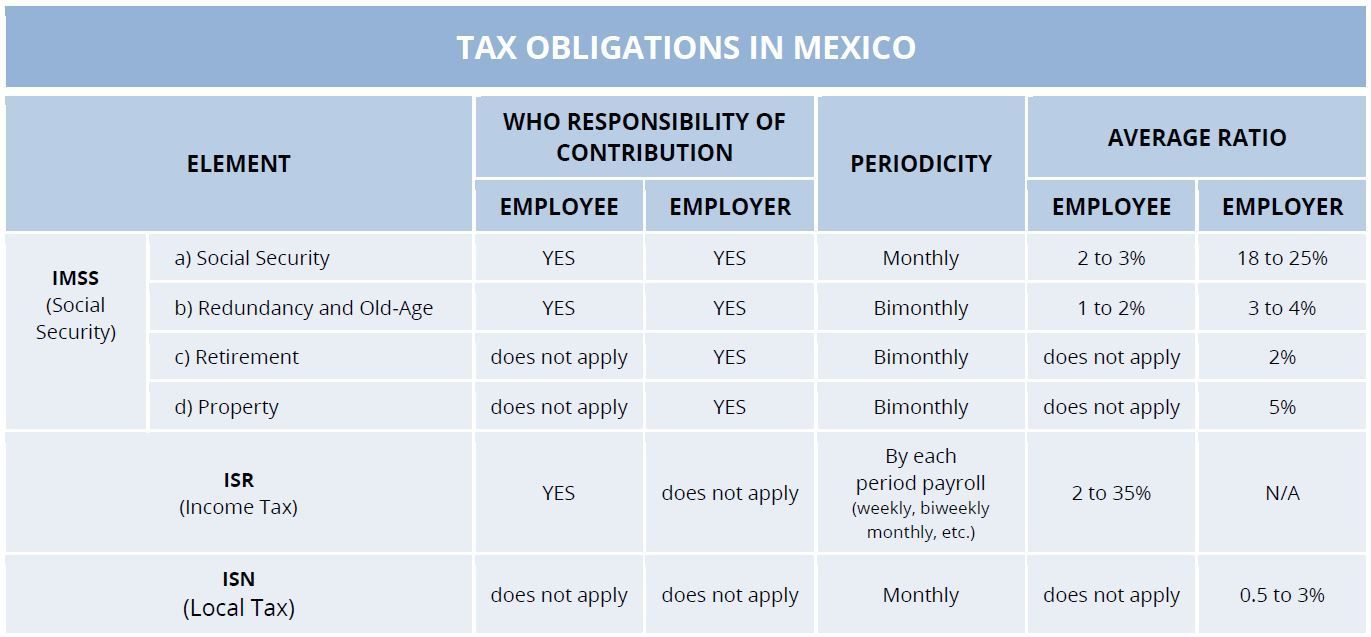

When calculating the withholdings to be applied to payroll it is important to note the following:

- IMSS: These are Social Security contributions withheld from the employee and paid by the employer.

- IRS (Labor Agency): This is the tax withheld from the employee and paid by the employer that is calculated according to the taxable basis. It is a progressive tax that will depend on the salary that the employee receives.

- ISN: local taxes are strictly employer funded.

The below table demonstrates the differences between the various contributions:

The payroll pay-slip

Since 2012 it is obligatory to validate and certify payroll pay-slips by the SAT. The Income Tax Act establishes the obligation of stamping all pay-slips by a certified authorized provider and a SAT-Interface payroll software.

As stamping is mandatory for all information contacting personal compensation, pay-slips must be stamped and sent to the SAT, companies are exempt from filing annual returns and salaries. This change was implemented at the start of 2018.

Employee Dismissal

There are two different kinds of documents that must be delivered to employees when they leave the Company: the settlement and the liquidation.

- This are the documents used in case of voluntary departures. They must cover the following elements:

- Pay according to the outstanding days of payment

- Bonuses proportional to the date of payment

- Other elements that the employee is entitled by law or contract

- It´s applied in the case of unilateral decision of the employer, without any reason attributable to the employee. The following elements must be covered:

- 90 day salary compensation

- 20 days per working year or proportional part.

- Old Premium.