Employee benefits (particularly medical coverage) are privately funded in the United States. The US Government does not provide non-government or non-unionized employees benefit coverage outside of unemployment, welfare (for those with no employment and no income), Medicare (public medical coverage for old age and eligible no income residents) and Social Security (retirement funding paid after age of 65 and disability). Although the US Residents pay taxes for Medicare and Social Security these benefits are realized in situations of loss of employment, retirement, and disability.

This is the main reason for the health crises debate that exists in the US. In short, if you do not work for a company that can afford a formal Private Benefit Plan/Package you have little to no protection and coverage.

Employers need to offer Benefit Plan/Coverage to attract employees and talent. Although benefit plans are costly and not legally required for small employers, majority of prospective employees will have benefit coverage as a requirement for their employment with an organization.

Employee benefits in the United States include Medical Insurance, Prescription Insurance, Vision Insurance, Dental Insurance, Retirement benefit plans (pension, 401(k), 403(b)) – the most sought after and common-, Health and Dependent care flexible spending accounts, Group term life and long-term/short-term care insurance plans, Legal assistance plans, Adoption assistance, Child care benefits and Transportation benefits.

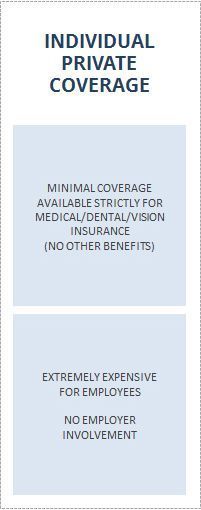

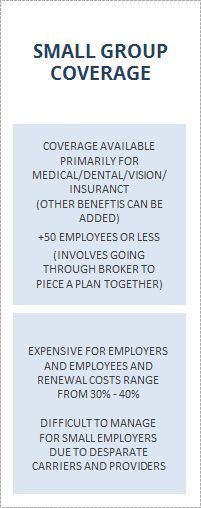

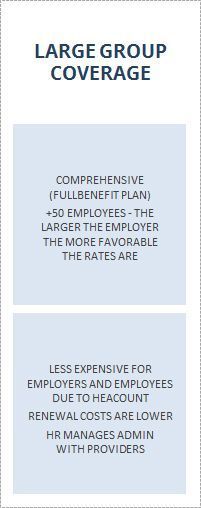

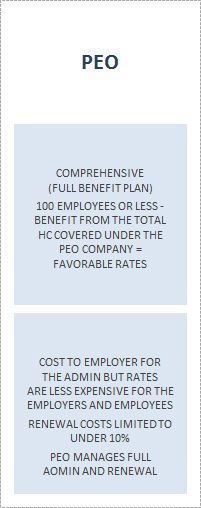

What are the options when it comes to finding a benefit plan and securing coverage for your employees?

If you are a foreign company looking to employee local US employees and have anywhere from 1-100 employees with limited experience with US HR and Benefits, a PEO solution, though costly, is often the best solution.

How do you elect a benefit plan?

How does cost breakdown?

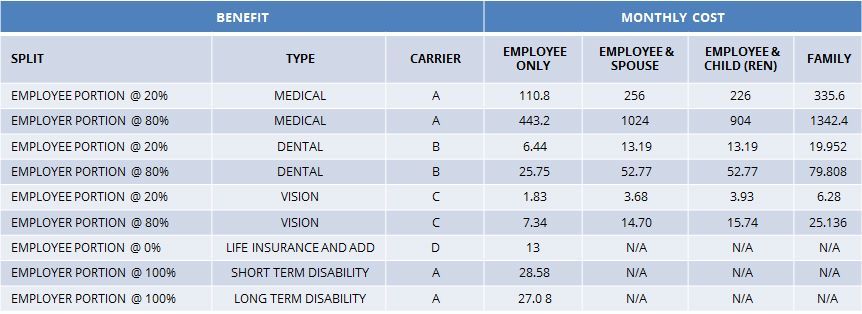

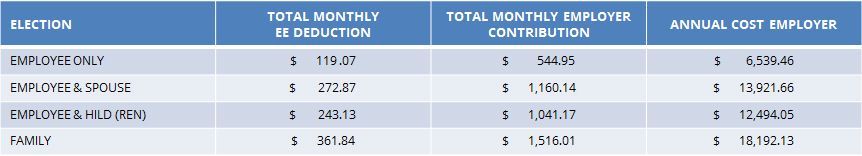

A typical Benefit Plan/Package has benefits that are the Employee Funded (deductions are managed via payroll) and Employer funded. Some Benefits are typically 100% Employer Funded (Life Insurance, Disability and ADD). The full Employer and Employee amount comprises 100% of premium that is due to the Benefits Carrier. Typically, the Employer will pay for 70%-80% of the premium and Employees will pay 20-30% of the premium. Premiums all depend on the carriers, plans elected and rates that are obtained (in many cases the employee demographic can impact rates as well). The plans offered not only provide employee coverage but also spousal and child coverage. The cost of the benefits varies significantly depending on all of these factors as the below:

It is important to do your research and review your options to ensure you secure the best plan and arrangement for your organization and for your employees in the US.